By Chris Okpoko

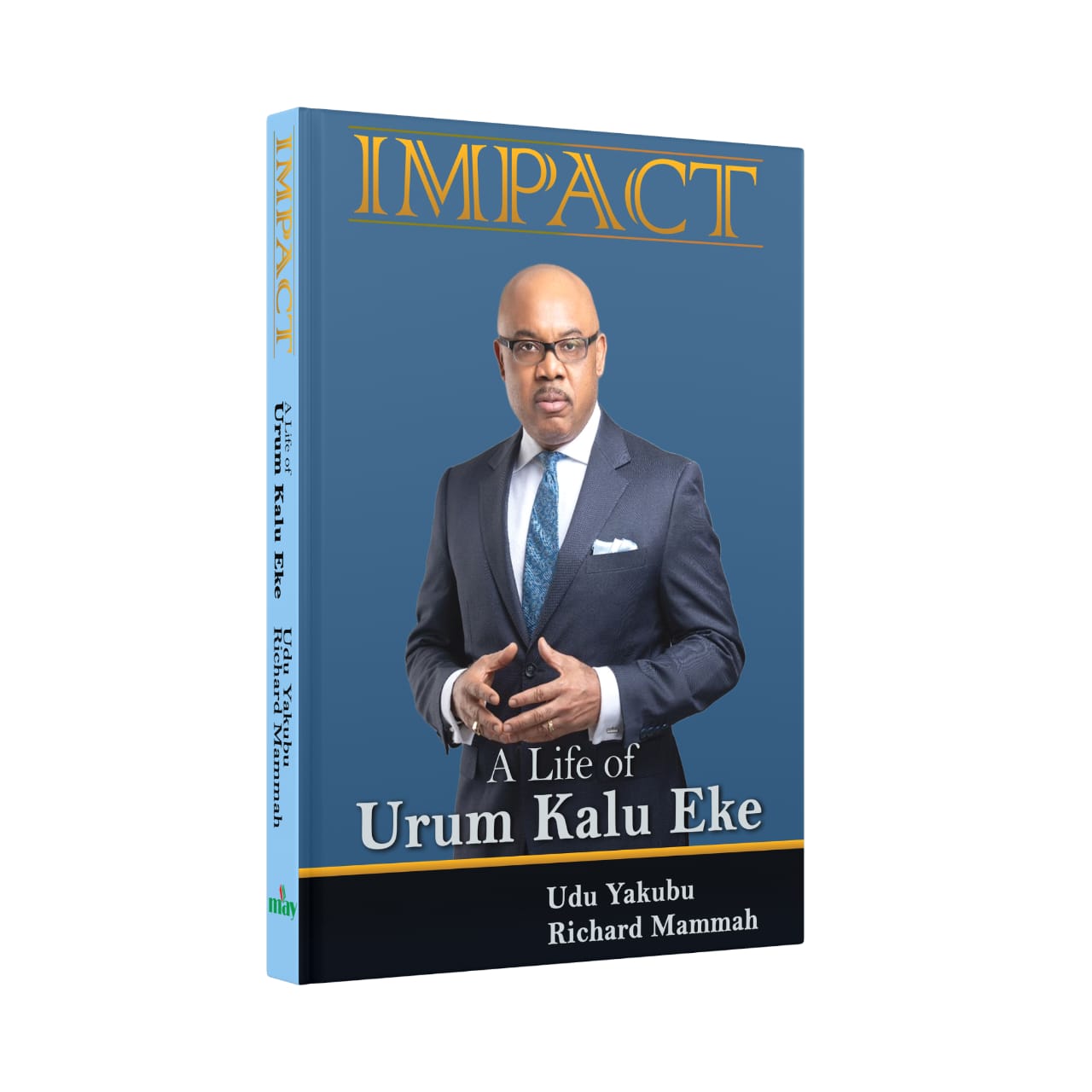

In the fast-paced world of banking and finance, where decisions are made in split seconds and strategies can alter the course of economies, few people have stood out as prominently as Urum Kalu Eke (UK as he is fondly called). His life, a tapestry woven with threads of ambition, resilience, and profound impact, offers a compelling narrative that transcends mere professional achievements. The book titled “Impact: A Life of Urum Kalu Eke,” authored by Udu Yakubu and Richard Mammah and published by MAY Publishing, is a meticulous exploration of a man who not only redefined banking standards but also left an indelible mark on the communities he served. As an exploration of sound investment principles, leadership, and Board dynamics, the book will resonate with readers, offering timeless wisdom that transcends market trends.

The book, which has 565 pages subdivided into 39 chapters begins with Abiriba, where it all began, his family roots, and childhood memories depicting how UK was born into modest beginnings in Surulere in Lagos State, and his early life characterized by challenges that could easily deter a less determined spirit. Raised in a family that valued education, he was instilled with the belief that knowledge is power. His father, a Scotland-trained nurse, and his mother, a housewife, served as role models who demonstrated the importance of perseverance and integrity. This foundational upbringing paved the way for UK’s relentless pursuit of excellence, driving him to excel academically and place education at the forefront of his ambitions.

Chapters 5 to 10 encapsulated UK’s academic journey, which took him to prestigious institutions where he honed his skills in Political Science, Accounting, Banking, and Finance. His time at university and Deloitte was transformative; it broadened his horizons and equipped him with the expertise necessary to navigate the complex Nigerian landscape. It was during these formative years that UK recognized the potential of banking as a tool for economic empowerment. Unlike many of his contemporaries, UK was not solely interested in personal gain. His vision revolved around using banking principles to uplift communities and provide opportunities for those who had been historically underserved.

Chapters 11 to 15, captured UK’s switch from Political Science to Accounting and the road to his successful banking career. This narrative showed how UK upon graduation from the university, spent his 1-year mandatory NYSC in the employment of Deloitte Haskins and Sells International and worked for another 5 years with the company, qualified as a chartered accountant, and rose to the post of audit senior/consultant. And when he entered the banking sector, he made a name for himself in various firms. The book delves into his early career, detailing how UK’s innovative approaches and keen insights propelled him through the ranks. He became known for his ability to foresee market trends and develop groundbreaking strategies that not only benefitted his employers but also laid the groundwork for more inclusive banking practices.

“UK was instrumental in advocating for several initiatives, recognizing that providing financial services to those at the base of the economic pyramid could yield tremendous benefits for entire communities.

”The subsequent chapters of the book highlighted the pivotal moments in UK’s career when he was appointed the Group Managing Director of FBN Holdings Plc. until his retirement in December 2021. Before that, he was an Executive Director with First Bank of Nigeria Limited and worked with Diamond Bank Plc. where he became an Executive Director. Under his stewardship, the bank not only flourished financially but also embraced social responsibility as a core tenet of its operations. His philosophy, which emphasized the importance of corporate citizenship, set new benchmarks within the industry. UK’s tenure saw the implementation of programs that fostered growth and sustainable economic development. Through these initiatives, he created a legacy that extended far beyond profit margins; he envisioned a banking framework that could empower individuals and inspire change.

One notable aspect of UK’s journey, as recounted in the book, is his approach to leadership. He believed in the power of mentorship, dedicating significant time to nurturing upcoming talents within the industry. His commitment to developing future leaders is a testament to his understanding that true impact transcends personal success. Many of those he mentored have gone on to become influential figures themselves, carrying forward his ideals of ethical leadership and community service.

The book also touches upon the personal sacrifices that accompanied UK’s rise to prominence. Balancing an intense career with family life challenged him, often leading to difficult choices that would shape both his professional and private identities. These candid reflections offer readers a glimpse into the complexities of leadership—a narrative filled with triumphs and trials that resonates deeply with anyone striving for success. UK’s influence extends beyond the confines of banking; it permeates social, educational, and economic realms. The biography presents real-life stories of people whose lives were transformed through the initiatives UK championed, illustrating how banking can serve as a vehicle for social justice.As the pages turn, readers will find an account not just of achievements, but of ethical dilemmas faced by UK throughout his career. The financial crisis of the late 2000s posed significant challenges, threatening to undermine the very principles he stood for. Yet, UK’s unwavering resolve led him to navigate these turbulent waters with a focus on transparency and accountability. His decisions during this period further solidified his reputation as a leader of integrity, reinforcing the notion that genuine impact requires a steadfast commitment to one’s values, especially in times of adversity.

Toward the end of the book, UK reflects on his legacy and the future of banking. His vision is clear: a banking system that prioritizes sustainability, inclusivity, and ethical practices. UK envisions a world where financial services are accessible to all, where every individual has the tools necessary to succeed regardless of their socio-economic background. The closing chapters encapsulate a blend of optimism and realism, urging the next generation of bankers to learn from the past while innovating for a better future.

“Impact: A Life of Urum Kalu Eke” is more than a biography; it is a roadmap for aspiring leaders in finance and beyond. UK’s story serves as a powerful reminder that true success is measured not by wealth alone, but by the positive changes one inspires in others.“

Through his journey, readers will discover the profound idea that banking, when utilized as a force for good, has the potential to transform lives and communities, ultimately leading to a brighter and more equitable future.

”In conclusion, the biography of Urum Eke captures a life rich with purpose, achievement, and impact. It stands as a tribute to an individual who dared to dream big and worked tirelessly to turn those dreams into reality. The authors, Udu Yakub and Richard Mammah, did a great job in this tell-all narrative of a leading Nigerian banker. As we review the pages of this remarkable story, we are invited to reflect on our paths and consider how we, too, can contribute to the greater good in our respective fields. Urum Eke’s legacy is a clarion call for ethical leadership, urging us to think beyond ourselves and embrace the transformative power of banking to create lasting change.

***

Chris Okpoko is a Research Editor at May Publishing and can be reached at: christopherokpoko6@gmail.com